November Elections: What to do Next

December 8, 2025

By Jim Schiele

Voters approved all 17 statewide constitutional amendments in the November 2025 election. Several of these measures will significantly impact Texas school districts—especially in terms of future bond issuances and property tax exemptions.

Key Approved Amendments

| Proposition | Key Change |

| Prop 9 | Business personal property exemption increases to $125,000 |

| Prop 11 | Homestead exemption for 65+ or disabled increases to $60,000 |

| Prop 13 | Homestead exemption increases to $140,000 |

Proposition 9

- Increases the business personal property exemption from $2,500 to $125,000, effective tax year 2026.

- No hold harmless provision to offset lost property tax revenue.

- Action Step: Contact your county chief appraiser to assess the impact on taxable values, estimate impact to local revenue.

Proposition 11

- Raises the state-mandated homestead exemption for those 65+ or disabled from $10,000 to $60,000 starting with the 2025 tax year.

- Hold harmless provided under SB 4, but TEA has not clarified the calculation details.

- Action step: Contact your county chief appraiser to assess the impact on taxable values, estimate impact to local revenue—including tax ceiling levy, and monitor TEA correspondence for information related to the calculation of the hold harmless provision. Contact your tax assessor-collector for estimated amounts, if possible.

Proposition 13

- Increases the state-mandated exemption for eligible homesteads from $100,000 to $140,000 for school district property taxes starting with the 2025 tax year.

- Hold harmless provisions exist under SB 23, but specifics remain unclear.

- Action step: Contact your county chief appraiser to assess the impact on taxable values, estimate impact to local revenue—including tax ceiling levy, and monitor TEA correspondence for information related to the calculation of the hold harmless provisions. Contact your tax assessor-collector for estimated amounts, if possible.

Impact on School Districts

- The hold harmless provision only offsets the increase in homestead and other exemptions and applies only to bonds already issued.

- Future bond issuances will rely on a smaller property value base, requiring higher tax rates to repay bonds.

- Action Steps:

- Contact your county chief appraiser to determine the impact on taxable value.

- Consult your financial advisor to calculate the effect on future bond issuances.

- Rework your state aid template to ensure accurate projections of revenue for the current year

Local Election Results

In local school district elections, voters across the state exhibited caution about approving new debt.

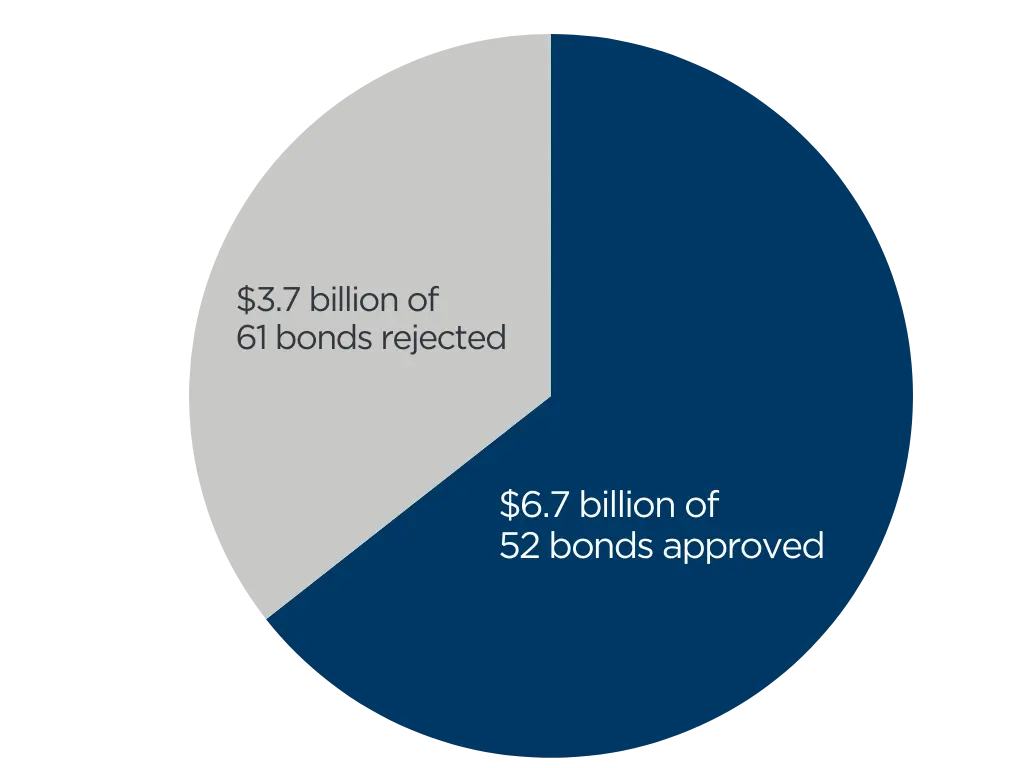

School districts proposed a total of $10.4 billion in bonds, of which roughly $6.7 billion (64.1%) were approved. However, only 46% of individual school bond propositions passed, significantly below the historical average of 63%. Many failed propositions involved non-instructional facilities (athletics, admin buildings), though some learning-related projects also failed.

State law now requires all school bond ballots to include the language “THIS IS A PROPERTY TAX INCREASE”, even if the district anticipates no change to the current tax rate, which may have influenced voter perception.

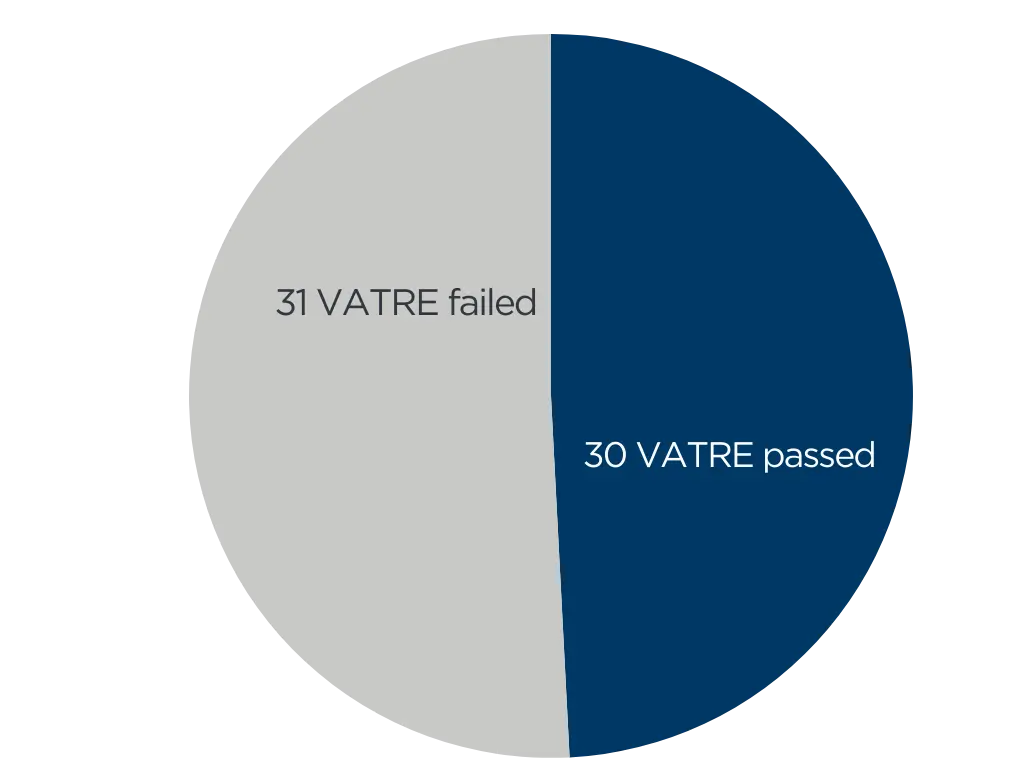

113 Texas school districts had bond propositions and 61 districts held VATRE elections

Post-Election Steps for School Districts

If your bond election passed, congratulations now you can prepare your team for the capital projects. This includes assembling your construction team, setting up construction schedules, and identify key district personnel to include in the project.

If your bond election failed, avoid simply re-running the same proposition. Start by analyzing who turned out to vote. Pull voter turnout demographics and break down the results by precinct.

Then reassess the essential needs of the project(s), how the bond was presented to the voters, and think through how you can revise and improve your community engagement strategy. Does this mean engaging stakeholders earlier and in more robust ways?

If your VATRE passed, congratulations, your budget is set and no changes need to be made to the tax bills.

If your VATRE failed, there are four key steps to take.

- Notify your tax assessor-collector (if they send bills) to adjust the notices/bills mailed to taxpayers

- Amend your budget to reflect reduced revenue

- Prepare for open meetings – remember meetings that discuss/adopt the budget must have an open meeting notice with a taxpayer impact statement and link to the proposed budget

- Begin planning for community education before any future attempt at a VATRE election

Looking Ahead

In future updates, we’ll dive deeper into:

- TEA guidance on new legislation including hold harmless provisions for increased homestead exemptions

- Strategies for running a successful capital projects program

- Strategies to rework bond propositions that didn’t pass and increase community engagement for your election

- Strategies for future VATRE’s including communication, websites, board involvement and increased community engagement

Need help analyzing your district’s financial impact or planning next steps? Contact us for a review and strategy session.

Jim Schiele is Linebarger’s School Financial Consultant. He offers free assistance to Linebarger school district clients as they navigate budgets and meet financial deadlines. He can be reached at jim.schiele@lgbs.com.

This content is intended and provided solely for educational and/or informational purposes. It is not intended to provide legal advice, nor does your receipt of this content create an attorney-client relationship. This content is not a substitute for the specific legal advice of an attorney licensed in your jurisdiction.

If you are a current or prospective client this content may be subject to the attorney-client privilege or the attorney work product privilege or otherwise be confidential. Any dissemination, copying or use of this content by or to anyone other than the designated and intended recipient(s) is unauthorized.